This content is from:Portfolio

The Five Worst Parts of the FCA’s Brutal Asset Management Report

The U.K.’s £6.9 trillion asset management industry is a market failure, according to findings from the country’s market regulator.

The U.K.’s Financial Conduct Authority released a小丑报告本月早些时候在该国的资产管理行业的国家,结论是,6.9万亿英镑(8.6万亿美元)的企业失败了投资者。临时监管综述 - 第一个此类报告,最终提出,由于2017年第二季度出版 - 批评U.K.的资产管理行业有效零售机构投资者。亚博赞助欧冠以下是最大的五个结果:

1: Asset Managers Reap Outsize Profits

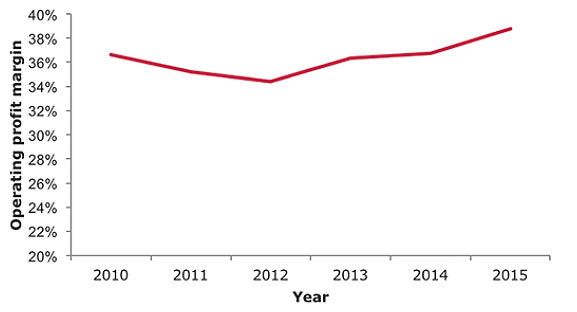

The FCA took an in-depth look at charges, costs, and profitability at U.K. asset managers. Based on data from 16 firms, it calculates an average profit margin of 36 percent over the past six years. Retail clients had a higher edge in profit margins, in part because of either less competition in the retail market or winning institutional business at a lower margin, the report finds. Larger firms’ revenues rose with assets under management, encouraging managers to become asset gatherers at the potential cost of performance, the FCA says.

“他们以更大的公司速度速度速度较慢,较大的公司通常会赚取更大的利润,”报告说明。FCA还将资产管理与其他行业的盈利能力进行了比较,并发现其仅限于房地产,为富时平均利润率为16%的股份。

Average operating profit margin Source: FCA analysis based on financial data submitted to the FCA from 16 firms.

Source: FCA analysis based on financial data submitted to the FCA from 16 firms.2: Investment Consultants Are Conflicted and Face Investigation

The report heavily scrutinized U.K. investment consulting firms, finding that the three largest firms — Aon Hewitt, Mercer, and Willis Towers Watson — had a combined market share of about 60 percent in 2015 but notes that small- and medium-size firms are gaining ground. One concern is the gift culture in the investment consultancy sector, which the FCA says could influence manager ratings. This includes asset managers purchasing services (investment conferences, data, and investment consulting) from consultants. The FCA says it will examine these situations more fully in the future.

根据这样的结果,FCA建议开发它对U.K.的竞争和市场权力(另一个监管机构)呼吁市场调查参考的制度投资咨询市场;它建议进一步调节。

For Andy Agathangelou, founding chair of theTransparency Task Force这是一个致力于提高养老金行业透明度的行业集团,这是潜在的比赛更换器,为U.K.投资顾问。“机构市场使用投资顾问的方式大幅度变化,”他说。“除非认为存在严重的市场失败,否则FCA不会向CMA推荐。”

3:对保密的反馈和“最有利的国家”条款

The FCA reports a lack of transparency on segregated mandate costs, particularly for transaction fees, annual management charges, defined contribution products, hedge funds, private equity, and fiduciary management. Because only headline charges are publicly disclosed in the institutional market, it is difficult for asset owners to benchmark costs, the FCA says.

4: Active Managers Don’t Outperform or Compete on Price

Tracking error against OCF for clean equity分享课程超过2013-15

积极管理人员不仅在成本后未能优越相关的基准,报告说明,但大约10.9亿英镑的积极资金比被动资金昂贵。对于机构亚博赞助欧冠投资者,根据行业跟踪器的2003-15个数据,费用后,费用的表现尚未与零有明显不同。

The report contends that both retail and institutional investors place too much emphasis on past performance. Although there has been limited price competition among active managers, asset management charges have not changed significantly over time, the FCA says: “Clustering of prices appears to be a feature of the asset management industry.”

目前,被动投资的市场份额约为U.K. Agathangelou说,如果U.K.遵循美国,并且在50-50之间逐步失去市场份额。他预测,养老基金和顾问将在更大的压力下实现,以证明使用积极管理人员的使用。

5:机亚博赞助欧冠构投资者可以并应获得较低的费用

Reducing manager fees is always a popular idea among asset owners, and the FCA report supports this, citing recent changes in the U.K. local authority pension fund sector as a good example of how pension funds can achieve significant cost savings by pooling their assets.

“Since the end of 2005, the total number of pension funds in the Netherlands has dropped from 800 to 365, and this trend does not show any sign of slowing,” the report states.

报告称,投资者必须持久地谈判:“当努力谈判价格时,资产经理将最初拒绝谈判,但在推动时会这样做。”

What the FCA’s Dressing-Down Means for Asset Management

Though asset managers’ initial reaction to the FCA report has been measured — echoing Standard Life Investments’ comment that it “supports the aims of the Market Study and is committed to improving transparency, value and outcomes for clients and customers” — it is likely a different story behind the scenes, with firms prepping a round of lobbying to impress upon government ministers that asset management is a vital part of the U.K.’s service economy, that attacks on it will discourage saving and investment, and so on. Meanwhile, there has been deafening silence from the investment consulting firms, which must be considering their response to a very strong challenge to their business model and reputation.

无论如何,FCA已经明确表示它认为U.K.资产管理行业有很长的路要走,以便在其客户服务的情况下进行 - 以及它的工作收取多少费用。Agathangelou指出,尽管在市场上运营了大量公司,但该行业在多年上享有持续高利润。“这似乎表明FCA得出结论,市场力量没有有效运作,”他说。

Matt Craig is the European Content Director for the Investor Intelligence Network, Institutional Investor’s private community for asset owners.