This content is from:xinyabo体育app

在厄运和繁荣之间打电话

In changing times, Mislav Matejka and his equity strategy team at J.P. Morgan are big vote-getters on the 2017 All-Europe Research Team.

投资者have shunned European equities over the past few years as the Continent struggled to recover from the financial and euro zone crises. But there may be life in European markets yet. The Stoxx Europe 600 index is up 0.32 percent year-to-date — a stark difference from the start of last year, when the index plunged into negative territory. The bellwether index did finish 2016 up 7.16 percent, enough of an advance that strategists on this year’s All-Europe Research Team ranking believe 2017 may be the year European equities bounce back.

美国银行Merrill Lynch的分析师,哪个tops the overall research ranking连续第二年,说全球增长的增加可能会使欧洲收益带出停滞,这是缺陷投资者的一个关键指标。金融危机陷入欧洲股市,虽然暂时推动European Central Bank’s stimulative monetary policy supported markets in 2015, earnings never followed. According to FactSet Research Systems, earnings remain 40 percent below 2007 highs. But if global growth holds at around 3.5 percent or goes higher, strategists predict, European earnings will rebound along with it. That could create new opportunities for long-term investors to get equities while they are still relatively cheap.

“We were surprised by how cautious global investors have become with respect to Europe yet again,” saysMislav Matejka,谁将J.P. Morgan Cazenove的全球股权战略团队带到第五次连续1号排名。Matejka是与股权研究召唤的名称。他和他的团队不得不采取最广泛的观点 - 跨越宏观经济,全球市场和地缘主义 - 在研究中,今年的投票证实,该学科只会在不确定性上升的重要性。股权战略有最多的选民和所有45个部门的第二票。Matejka本人获得了第二次最高的投票,以及排名中个人的第三大百分比。

“我们相信,如果反射主题开始看起来更可靠和可持续,那么欧洲也将在这种情况下受益。在过去的七年中,在向下通胀螺旋的七年中显然受到伤害,“克罗地亚天然和伦敦经济学院和政治科学毕业学院”观察。

他说,他的团队的关键关注现在正在评估最近的新生的偏离偏离风险和反向反射将有腿:“债券收益率的方向是这方面的重要参数。我们说的许多投资者认为债券收益率不会持续走高,如果他们这样做,那将最终成为股权和其他市场的大问题。他们担心全球经济将无法容忍更高的收益率。“但Matejka和他的团队有所不同。他们认为,如果屈服升高,它将最终适合市场,特别是股票。

“The move up in bond yields might compel asset allocators to finally start repositioning out of fixed income, and allow the leadership within the equity market to broaden out,” Matejka notes.

Matejka甚至发现自己有一个绰号 - 或者至少分享一个,由金融博客零对冲,他的同事,Marko Kolanovic,全球定量和衍生品首脑,在J.P. Morgan:“厄运克罗地亚语二人队”。(Bloomberg一旦被称为Kolanovic“Gandalf”的预测技巧。)原因:他们对美国股票的看跌姿态。Matejka发布了一项研究报告,表明,与欧洲不同,市场可能准备遭受反弹,美国市场的投资者会卖得很好地卖给集会,并采取比过去七年更加防守的姿态。他自以来对这种立场进行了一些战术更新,反映了自选项以来的变化,但球队愿意违背谷物的声誉是众所周知的。

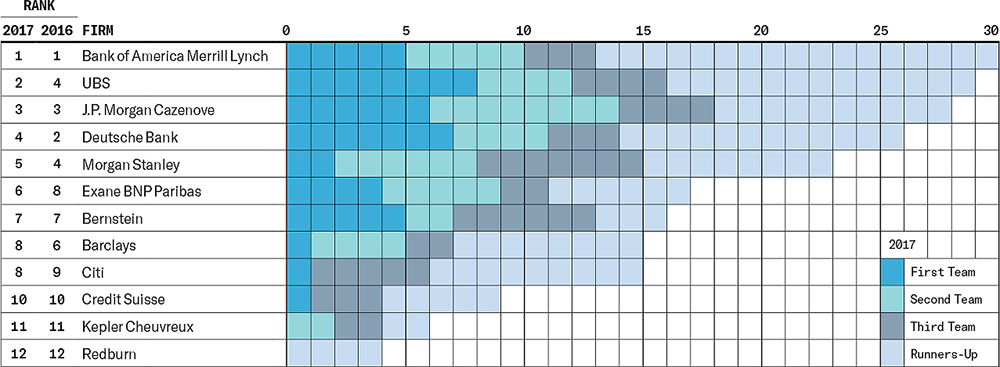

领导者2017年全欧洲研究团队的公司获胜者表现出稳定的稳定性。Bank of America Merrill Lynch repeats at No. 1, while UBS moves up two spots to No. 2. J.P Morgan Cazenove hangs tight at No. 3, Deutsche Bank slips two to No. 4, and Morgan Stanley falls one place to No. 5.

全欧洲研究团队排名是基于欧元100欧元的货币管理人员的回应,亚博赞助欧冠欧洲100个最大的机构投资者以及其他主要亚洲,欧洲和美国投资者的阵容亚博赞助欧冠。在计算权重中,该列表侧重于分析师团队而不是个人。2017年队伍反映了784名机构在欧洲股市监督估计6万亿美元的机构中超过2,300钱经理的意见。

Even if earnings start to catch up, European equities will still have a way to go. The start of the year saw a lot of commentary on the possibility of a “great rotation” out of bonds and into equities, but that hasn’t begun. Strategists point out that many investors worry about political and macroeconomic issues in Europe, including upcoming elections in France and Germany. There is also a significant legal overhang for European financials from the financial crisis. It’s no surprise that Bank of America Merrill Lynch and J.P. Morgan — the top banks in the leaders table and weighted leaders table, respectively — are U.S.-based. J.P. Morgan recently claimed the top spot in investment banking market share in both the U.S. and Europe in its latest earnings report. U.S. banks have rebounded admirably; their capital structures are different from those of their European counterparts, making them more resilient to increased capital requirements and volatile markets, which has allowed them to take local market share from European banks.

德意志银行那on the other hand, which is joint No. 3 for overall strength, has a much thinner capital reserve after its recent spate of massive fines and settlements, including its deal with the U.S. Department of Justice over mortgage practices leading up to the financial crisis. The bank’s overall business has been suffering as well, prompting staffing cuts and crippling its ability to take on risk in a bid for more revenue. Add to that low interest rates and sluggish local growth, and it’s hard to be upbeat about Deutsche Bank or other European banks.

This disparity between U.S. and European banks is having a chilling effect on the Basel Committee on Banking Supervision, which agreed to push back its implementation of new capital requirements until March at the behest of European bankers and policymakers, who said that proposed reserve requirements would be too much to bear while the recovery is still in early stages on the Continent. The delay gives everyone more time, but it also adds uncertainty around what the requirements will ultimately be and when they will be enforced.

在所有这些底线担忧中,欧洲的另一项监管推动可能会改变资产经理如何改变资产管理员的来源和支付研究 - 潜在地为欧洲银行创造新的利润头痛,从研究中产生相当大的收入。欧洲监管机构呼吁提高定价透明度,围绕如何传播研究的冲突较少。虽然这似乎很简单,但改变与关于资产管理的更大和更广泛的辩论以及投资者应该支付的是什么。“这是一个全球性问题,”伯恩斯坦高级定量分析师Inigo Fraser-Jenkins说,他在排名第一次出现在他的团队中。

随着投资者继续Fraser-Jenkins指出base allocation decisions about active and passive products largely on fees, the cost of research will become almost as important as its content. “A lot of issues around research are bound up in this debate, in terms of who pays and how asset management works. Business models may have to change,” he says.

Bernstein is something of a pioneer of this model by offering research as an independent, stand-alone product. The firm leads a number of sectors in the ranking, and many analysts say independence allows for deeper research coverage and lessens the pressure to focus on managing or expanding banking relationships.

更传统的销售方分析师仍然是关于研究在银行业关系中的作用的哲学。最重要的一致认为,即使它是如何进行改变的支付方式也将永远存在一个地方。资产管理者还是会想要一个视图到他们所投资的公司,但缺乏资源,内部盖。投资者也很可能会寻求信息的来源,他们可能无法靠自己乐于众多。

技术还将在维持资产管理关系方面发挥越来越关键的部分。从账户管理到交易如何研究研究的一切都是通过技术改造的。“A big irony is that a lot of quant funds haven’t recovered to their precrisis AUM, but so much of asset management now rests on a quant-style infrastructure in terms of technology and approach,” says Fraser-Jenkins, noting that the potential for further technology-driven cost cutting will likely be significant.

虽然辩论围绕这些主题遍历,但分析师本身正在同时指导谈话并通过它的生活。分析师充当导管,在他们的地区开发专业知识并分享可以移动市场的信息。他们还与具有许多义务的公司和投资者建立了关系。“人们正在以最高级别与这些问题与这些问题有关,”弗雷泽 - 詹金斯说,他补充说,这使他对研究感兴趣的是长期职业:“更大的战略问题是在过去30年中投入投资在感觉中相对容易,相关性已经明确,并且趋势直截了当。这不再是这种情况,而且我们将来不太可能回到那里。所以我们必须考虑如何在这个新的环境中运作。“