投资者have a tougher job today than ever before. They're taking more risk than in decades past in order to achieve similar returns. And they're doing so against a backdrop of geopolitical and market uncertainty — things they cannot control, but still must take into consideration. Understandably, that sense of uncertainty, coupled with the need to take more risk, is driving investors to focus on what is tangible and easy to measure — in an effort to gain some sense of control. We see investors spending a lot of time anchored to short-term past performance — three year returns dominate decision-making for example — as well as tracking traditional, price-momentum benchmarks that point more to changes in prices than true, long-term value. But these metrics don't matter as much to investment outcomes.

所以是时候有一个破坏性的谈话了。我们希望帮助投资者回到他们所知道的时间始终计算更多 - 人,过程和哲学,也是在时间范围内的健康剂量的诚实。

然而,在一个变得如此短期关注的世界中,这是一个重要的障碍。周围缺乏清晰度,似乎是一个不断增长的公约,并且难以与流行的情绪打破,特别是在焦虑的时候。市场更复杂,找到回报更具挑战性。但这是一个重要的事实。看什么是易于测量的(例如无尽的数据比较)仅创造了控制的错觉,并进入了模糊的厌恶 - 这是一种已知的行为偏见,因为我们不喜欢不确定性。1

Also, short-term micro-measurement doesn't help forecast the future, generate returns or meet investors' long-term goals. Rather, it causes pro-cyclical (herding) behavior among investors, which, as noted by the International Monetary Fund in a paper on countercyclical investing, takes them away from their inherent "edge as long-horizon investors."2

虽然投资者在搜索过程中花费相当多的时间评估投资经理的关键属性,但它们倾向于在招聘后的评估中刷掉这些指标,特别是在短期表现不佳的时期。恢复绩效测量可能是常见的做法,但依赖于不持续存在的危险。

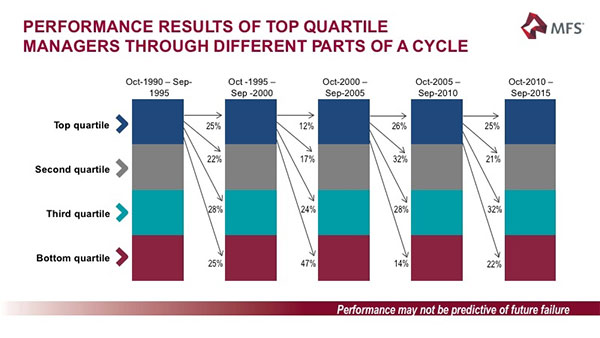

As you can see in the exhibits below, even the top-performing managers don't stay on that pedestal from period to period. For example, of the managers who performed in the top quartile from October 1990 to September 1995, only 25% remained in the top quartile in the subsequent period from October 1995 to September 2000, while the rest dropped down to lower quartiles. On the other hand, looking at the second exhibit, which shows what happened to bottom quartile managers over the same time periods, 27% of these managers went from the lowest performance ranking to the top performance ranking in the subsequent period.

资料来源:积累联盟。数据分析:MFS投资管理。

宇宙在Evesment数据库中包含了456个策略,其中包含所有美国股权和在09/30/1990或之前或之前的成立日期。排名包括幸存的投资和在完整计算期间之前清算和/或合并的排名(10/1 / 1 / 1990-09 / 30/30 / 2015)。每个四分位数代表25%的宇宙(即前25%下降到底部25%)。性能用于其可用的时段。表现是计算的费用额。每五年期间都分析了整个资金宇宙。Analysis tracked movement of top quartile of universe from period to period, and used the historical 25-year period ended 9/30/2015, to illustrate full market cycles.

资料来源:积累联盟。数据分析:MFS投资管理

宇宙在Evesment数据库中包含了456个策略,其中包含所有美国股权和在09/30/1990或之前或之前的成立日期。排名包括幸存的投资和在完整计算期间之前清算和/或合并的排名(10/1 / 1 / 1990-09 / 30/30 / 2015)。每个四分位数代表25%的宇宙(即前25%下降到底部25%)。性能用于其可用的时段。表现是计算的费用额。每五年期间都分析了整个资金宇宙。分析从期间到期的宇宙顶部四分位数的分析,使用历史25年期间截至2015年9月30日,以说明全部市场周期。

投资经理的人民,过程和哲学 - 反映了集体情报,文化和才能管理的力量,往往更加坚持。亚慱体育app怎么下载为什么投资者这么多?因为这些品质可能会反映经理在必要时违反粮食的能力,应用其对寻找机会的洞察力其他管理者可能缺失,并且可能识别其他人可能不会识别出风险。简而言之,投资者希望看到经理的迹象是反周期性的。

The harder-to-measure manager attributes are also highly relevant to the environmental, social and governance (ESG) conversation. We believe ESG is often misconstrued as more of a social/responsible investment decision. That has driven some investment managers to respond with a relevant product set. In reality, ESG is much more about trying to invest in good businesses rather than bad — finding those with true long-term value by understanding what factors (e.g。良好的管理,有效的资本配置和卓越的产品和服务)是公司可持续性和竞争优势的材料。将这些考虑集成到投资过程中 - 无论您是投资经理选择证券或资产所有者,选择投资经理 - 是否会降低风险,并随着时间的推移潜在地提高回报。但要耐心和强大的研究,了解长期的材料。

Passive management typically does not integrate ESG factors, and yet we believe these considerations are more important than ever to "getting it right" for the investors we serve. But getting it right depends as much on the investor as it does on the investment manager. Investors' time tolerance has to align with how their investment managers make decisions within their portfolios, or the resulting misalignment could damage both expectations and outcomes. For example, portfolio turnover is an important consideration in aligning investor horizons and manager decision making. When investors see an active manager with low portfolio turnover (i.e。一个长期焦点),他们可以更好地理解为什么经理需要一个完整的市场周期来生成alpha。

The work we do as an industry to improve the misalignment between investor time horizons and investment manager decision making is really about improving trust. Because ultimately investors need to trust a manager's skill long enough to allow it to work.

1Risk, Ambiguity and the Savage Axioms, Daniel Ellsberg,The Quarterly Journal of Economics, Vol. 75, No. 4 (November 1961)

2"Institutionalizing Countercyclical Investment: A Framework for Long-term Asset Owners," Bradley A Jones, International Monetary Fund, February 2016

The views expressed in this post are those of MFS, and are subject to change at any time. These views should not be relied upon as investment advice, as securities recommendations, or as an indication of trading intent on behalf of any other MFS product.37041.1

More active management insights from MFS experts atMFS.com/GetActive.