This content is from:Portfolio

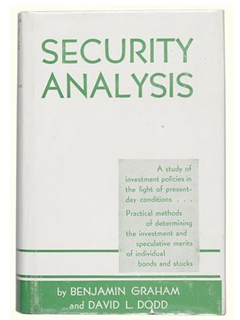

The Guttenberg Bible of Wall Street Goes To Auction

A rare second edition of 'Security Analysis, Principles and Technique,' which was written by Columbia professor Benjamin Graham and protégé David Dodd in 1934, is now under auction at Sotheby’s for estimated $4,000 to $5,000.

It’s considered the Guttenberg Bible of Wall Street, the value investor’s most valuable investment. The book was written in 1934 and is still recommended as a top read today for anybody who wants to understand and profit from the markets.

But who would have thought that a rare second edition of the Graham and Dodd book, Security Analysis, originally selling for less than a buck during the Great Depression, would be auctioned at Sotheby’s on June 17 for an estimated $4,000 to $5,000. Many Wall Streeters would say that’s a bargain.

The book was written by a professor who taught in the literature department of Columbia (as well as in economics and philosophy) and one of his most brilliant students. The book's full title was “Security Analysis, Principles and Technique,” a prosaic title their publishers thought would never sell widely. But the book by Benjamin Graham and protégé David Dodd went on to became the longest running investment text ever written.

The Wall Street crash of 1929 inspired Graham whose fortune was wiped out. He sought to find a more structured and reasoned approach to investing than the haphazard methods of the time based on insider tips, touts and hunches. Graham was the mind behind the method. Dodd took the notes and did the organizing. His transcriptions served as the basis for the tome now considered the bible of investing by the likes of Warren Buffett, Mario Gabelli, John Bogle, Michael Price and many others who put the words to profitable action.

Graham and Dodd insisted their methods did not require a lot of capital or sophisticated knowledge, rather a disciplined application of common sense. Logic and disciplined thought would enable any investor to find securities “selling well below the levels apparently justified by a careful analysis.”