此内容来自:文件夹

The Secretive Town at the Center of the World’s Oil Market

Cushing, Oklahoma, set the stage for the Great Oil Price Crash of 2020. But was it really to blame?

On the way to Cushing, Oklahoma, a young man, weary from the traffic and the chaos of the mule skinners, teamsters, and oilmen, sought refuge in a cobbled-together, unpainted saloon at the side of the road. He had been hub-deep in the mud for more than an hour, waiting to get into town, but had traveled less than a mile in the waning twilight.

令人沮丧,他向酒吧订购了饮料。瞥了一眼,他看到一个醉酒的男人散落在地板上。附近,两名男子瘫倒在一张牌上,点头。调酒师似乎兴起,当他说话时忽略了他。当他触动了调酒师的手臂时,那个男子撞到了锯末覆盖的地板上的堆。那是当年轻人注意到收银机打开和空虚。房间里的每个人都死了。

匆匆外面,喊道,“谋杀!”那个男人试图向下帮助,徒劳无功。这是缓冲的石油繁荣的高度。到1917年,该镇每天抽水超过30万桶。没有一个缓冲的野外野科员工 - 其中的未来石油亿万富翁J.Paul Getty - 想在水上碰撞线上失去他的地方。暴力是司空见惯的。抢劫,抢劫和谋杀是景观的一部分。这是一个故事在居民到今天的故事,并且可以在录制上找到库舒:前100年.

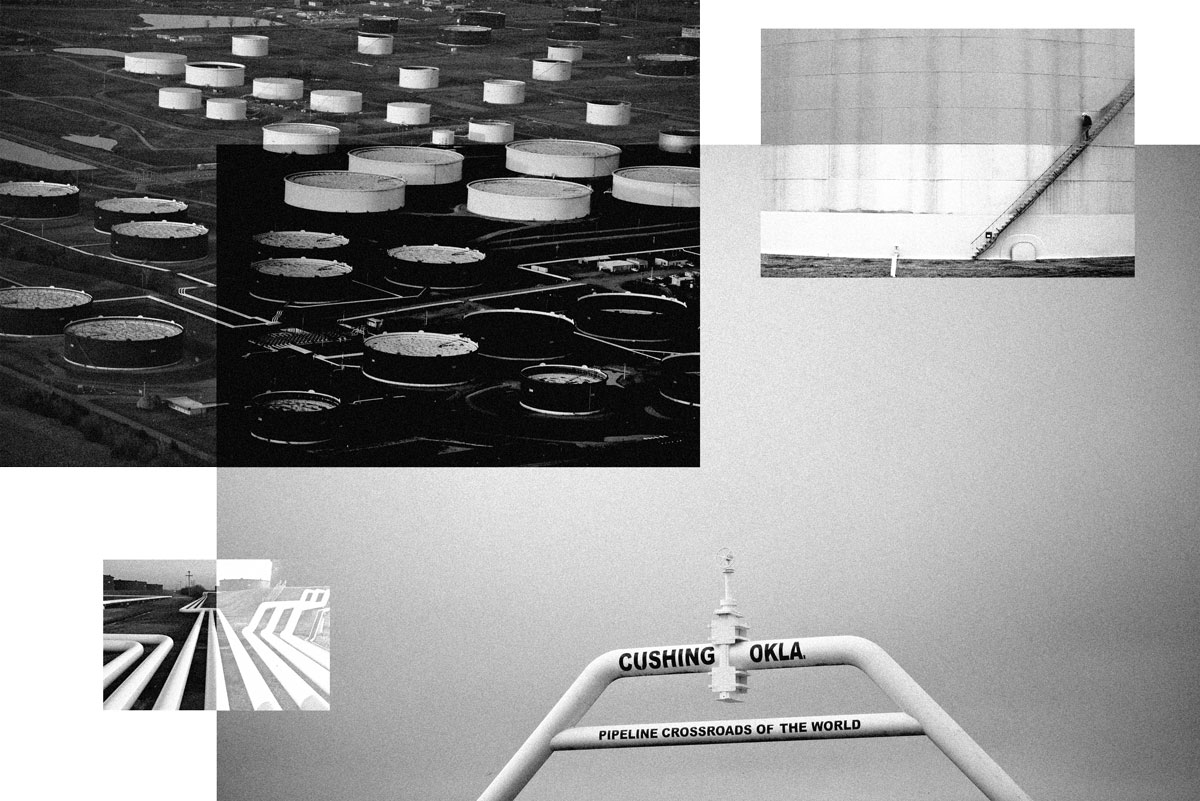

Once at the center of America’s black-gold rush, Cushing is now the world’s largest onshore oil storage and energy market hub. Signs of its long, tumultuous history can be seen throughout the town, which is situated on a barren plain surrounded by muddy grasslands. Pump jacks swinging their slow, mesmerizing limbs search for the last of the region’s oil in backyards, schoolyards, churchyards, and empty lots. The city’s population, which peaked in 1930 at just below 10,000, has been in decline ever since, lingering at slightly above 7,000. The town’s graveyards have more people in them than the homes. Beneath the ground, oil pipelines converge from every corner of North America, harking back to when oil flowed in Texas and Oklahoma seemingly without end.

“It’s just been a part of life here for as long as I can remember,” says 70-year-old Farrel Kleckner, a retired postman and a lifelong resident of Cushing. He also serves as the town’s honorary historian. “When I was a kid growing up on Cherry Street, I’d go out on the porch and the whole town would smell like sulfur. No one complained. People would say it smelled like money.”

But the tiny town of Cushing is now the focus of a monthslong government investigation into why the price of West Texas Intermediate light sweet crude oil futures droppedbelow zero4月20日,在安定之前,在减去40.32美元的桶中缩短交易

–$37.63.

“每个人都会记住石油市场的一件事是它在2020年遭受了负面,”伦敦标准的商品研究负责人Paul Horsnell说。“这是一个物理故事。这是一个很好的故事,因为这是一个共鸣的故事。看着大流行时期在世界上发生了什么。很多人都很恐慌。市场受到极端压力,价格和需求迅速下降。库弯的数字确实看起来非常可怕 - 但是加上着柔软的没有失败。“

The reason Cushing is a physical story是它为全球投资的投资者对地球上最重型商品的投资者提供了物理桶:轻质原油期货,在纽约商品交易所交易。

我ndeed, it is the connection between the cash prices for Cushing’s “wet” physical barrels and the “paper” prices of Nymex crude oil futures contracts that gives the market its credibility. Each Nymex contract is exchangeable for 1,000 barrels of physical crude oil.

在英格兰牛津的霍诺尔一直在雪福德,一直在靠近俄克拉荷马城的坑站。“没有什么可以看到或做的;这只是一个管道十字路口,“他说。“但我总是坚持要采取转移,很多人的同事的挫败感。”

每次他去过,他都会调查该镇的“坦克农场” - 从北向南延伸的数百家大量钢油罐,就眼睛可以看到。

曾经是“印度领土”的孤独的前哨是对西德克萨斯中级期货合约的石油桶不太可能的物理交付点,但它很久以前就有了它的石油繁荣。距离休斯顿国际航运频道以北500多里,距离最近的大都市至最近的大都会 - 俄克拉荷马城市70英里,距离华尔街1,400英里。

When the first crude oil contract started trading there, few suspected it would permanently put Cushing on the map, let alone rivet generations of Saudi oil ministers and market prognosticators, but that’s exactly what happened. Launched in 1983, the Nymex crude oil futures contract almost immediately became a global benchmark and, to this day, remains the basis for how banks, hedge funds, trading firms, power plants, gas stations, and fuel distributors around the world price a barrel of oil.

在近四十年中,自从“缓冲的石油管道和储存基础设施”迅速扩张,吞噬了数百英亩的城镇及其郊区,其中少数公司占据了地形和利润。“石油合同的交货点是在那里,因为基础设施已经存在,现在有更多的基础设施,因为合同在那里,”霍诺尔解释道。

“这是一点历史事故,”他补充道。

The reason Cushing’s numbers looked so horrible last spring is that, just as oil prices fell below zero, the town’s oil storage tanks appeared to be nearly full, triggering a price collapse that did not stop, even when the barrel lost all value. At the time, investors were racing to liquidate their positions in Nymex crude oil futures before the contract expired and entered its delivery phase in Cushing. Many were forced to sell at negative prices after learning there might not be enough room left in Cushing’s oil tanks to take delivery.

鉴于Cushing的特质,这种事件虽然罕见,但不一定是令人震惊的。“事实是,当你有身体交付时,商品是大笨重的东西,”霍诺尔说。“市场的机制可以对价格进行奇异的影响。物理交付的商品不像经济稳定的合同。当您进入商品时,您可以使用身体交付进入各种问题。基础设施问题。物理商品是一部分的旧经济,是笨重的。“

Crude oil’s plunge into negative territory is now the subject of an investigation by the U.S. futures regulator, the Commodity Futures Trading Commission. Although oil prices have not turned negative again, questions remain about what, exactly, happened and if there was市场操纵afoot. In the aftermath of the price crash, CFTC chairman Heath Tarbert announced that he would undertake a detailed forensic study into what he called “the crude oil price aberration on April 20.”

由CFTC的市场情报部门领导并由该机构执法部门的监督团队支持的探针现在已经延伸了近七个月。

Pivotal to the CFTC’s investigation is determining why Nymex crude oil futures became completely derailed from Cushing’s cash market for wet barrels, which, throughout the month of April, was not trading at negative prices. For there to be an orderly market, oil price discovery functions must align, and on April 20 they did not. The futures contract “ultimately relies on convergence,” Tarbertnotedlast spring. “At the end of the day, the futures price needs to be the same as the cash.”

塔尔伯特最初在去年4月下火了解,他提出评论,表明负油价似乎是“基本供需问题”。7月,他重复了这篇论文,陈述CFTC的深入分析“将[ED]指出了基本和技术原因的汇合”,因为石油的负面价格摇摆,警告供应和需求因素可能足以解释异常。

从那时起,塔伯特并没有揭示他的团队的调查结果,但是亚博赞助欧冠has learned that a draft of the report is being circulated among the CFTC’s commissioners for feedback and approval before being made public. The final report is expected to be released before the end of autumn.

与此同时,投资者已经搬到了,霍诺尔说,CuShing的霸权仍然很大程度上毫伤害。

“People are still trading this market,” he notes. “No one left because of what happened. Who’s going to come up with an alternative when this one works well enough 99.9 percent of the time?”

Not surprisingly, the citizens of Cushing— as well as the billion-dollar energy companies operating the town’s oil pipelines and tank farms — don’t take kindly to being put under the microscope. Particularly when oil is trading at less than $50 a barrel.

“住在这里,你来欣赏市场的挥发性是多么令人挥之索,它是多么珍贵,以及如何在分裂的第二个,它可以全部翻转,”Tracy Caulfield,居住在25年以上的居民和总裁兼主席库什林商会执行。“油价随着大流行的袭击发生了什么,与我们无关。它是华尔街和石油交易市场。当油价像那样,它会影响我们的社区,我们的城镇。我们是受害者。指向我们的手指,这很疯狂。哇。”

石油价格暴跌后的第二天,一个Facebook视频eo circulated among Cushing’s residents, featuring an energy executive explaining that, when oil prices fall below zero, “basically what that means is, you got a guy in Manhattan, New York, who’s trading futures contracts who has no intention of taking physical barrels of oil. He doesn’t want the physical delivery of oil, so he has to sell those contracts to somebody who actually does, such as a refiner or an airline. So the problem was the oil price went down so rapidly the traders needed to pay people to take those contracts.” The Chamber, which posted the video on social media, wrote, “There may be more layoffs because of this [price] plunge. Please pray for our oilfield community.”

Tyson Branyan, chair of the Cushing Economic Development Foundation, which works with some of the biggest oil storage and pipeline companies in the region, including Plains All American Pipeline — the largest — Enbridge, Magellan Midstream Partners, Enterprise Products Partners, and Energy Transfer, insists no one in the industry believed oil’s nosedive was rooted solely in market fundamentals. “In a rural town like this, everybody knows everybody, and we all know those prices were not grounded in reality,” he says. “We all just kind of laughed about it. There was never a real fear — they always have a little extra room in the tanks that they leave open, no matter what.”

That’s not to say the situation did not present real challenges, says Matthew Ramsey, chief operating officer at Energy Transfer, which runs several pipelines and more than 8 million barrels of storage capacity in Cushing. “When you have a drop in demand like that and crude barrels are still being produced, coming in from upstream, you really cannot just turn it off the way you might think you can,” he tells亚博赞助欧冠. “There was a genuine concern because of dwindling capacity that we might actually get to that place.”

Ultimately, crude oil supplies did not top out in Cushing. According to the Energy Information Administration, the statistics arm of the U.S. Department of Energy, Cushing’s oil storage levels came in at 63.4 million barrels for the week ended April 24, more than5 million barrels offof Cushing’s record high of 68.6 million barrels, for the week ended April 14, 2017 — a week that saw no negative price action, although it was also approaching contract expiration.

我n fact, Cushing’s oil storage levels did not even reach their year-to-date high until the following week, when they came in at 65.4 million barrels for the week ended May 1. “If negative oil prices were going to be determined by oil storage running out, then the smart money was on that taking place in May, not April,” Horsnell says.

Cushing’s total oil storage capacity, as of the EIA’slast reading今年3月,桶是7580万桶。即使储油水平弄脏,所有这些都意味着伴随着数百万桶的蠕虫室。虽然市场参与者可能会被租赁储存从库押的坦克农场租赁,但镇上的一些空间可以回忆一下空间跑出的时间。“你总是要留下懈怠的空间,”石油业务发展高级副总裁Shaun Revere说。“由于操作流动,总有一些房间,因为桶不断进入并出门。”

Though the momentum of barrels coming in and going out from all over the U.S. and Canada can be nearly impossible to interrupt, terminal operators in Cushing do have complete control, says Todd Stamm, vice president of pipeline operations at Energy Transfer. “Technically, you can stop taking barrels, yes. I would compare it to any other emergency, where you can physically shut it down if it gets really bad. But that’s why you have storage, to help you with that balance of barrels coming and going.”

EIA 11月发布了一个新的统计跟踪ing Cushing’s overall working storage capacity for barrels of crude. According to the new data, the week oil prices fell below zero, Cushing was utilizing 81 percent of its working storage capacity, compared with 83 percent the following week, when oil prices were back to trading in positive territory, at $20 a barrel.

我n other words, if Cushing’s energy infrastructure is to be blamed in any way for the extreme price moves of this past spring, the CFTC needs to clearly explain why prices never went negative before, even at times when oil storage levels were demonstrably higher and the Nymex crude oil futures contract was also about to expire. It’s also noteworthy that there were no delivery problems for anyone holding Nymex oil futures contracts in Cushing, despite the oil price crash.

“It’s undeniable that Cushing set the stage for the day’s events, but that doesn’t necessarily mean Cushing is to blame,” says CFTC commissioner Dan Berkovitz.

Cushing’s secrecy is a long-standing part of its history— and it is foundational to America’s financial and national security. Because the town houses the largest onshore oil storage complex in North America, its terrain and airspace are carefully guarded by U.S. Homeland Security, the Federal Aviation Administration, the Federal Bureau of Investigation, and a wide range of other national and state authorities.

“在9月11日之前,您可以在不必经历击剑和所有检查站的情况下走到坦克,但你不能再这样做了,”笔记了商会的Caulfield。“看看有多少人想要从家里脱离他们的家人是非常令人震惊的!- 去看他们。他们来到了房间,人们来提出询问着红色旗帜的各种问题。“

虽然可能没有孤立的土地没有更大的土地监测,分析,并在美国巡逻而不是缓冲,即使它的管道和坦克农场运营商也不完全确定镇上有多少活跃管道和储罐。“这是一个蜘蛛网,我们真的不是通过管道的数量来衡量它的,”能量转移Coo Ramsey说。“我们通过管道连接来测量它。”

Cushing’s energy pipelines, which connect countless points across the U.S. and Canada, handle about 3.7 million barrels a day inbound and 3.1 million barrels outbound, according to Energy Transfer’s Revere.

He notes that Cushing’s total oil storage capacity is far greater than what has been previously reported by the EIA, estimating it is currently about 94 million barrels.

Often, when asked to estimate the number of total working storage tanks or pipelines in the town, Cushing’s oil and gas employees will shrug. “We take wild-ass guesses,” one says. “Or we take strategic wild-ass guesses.”

So difficult is it to get an accurate reading of numbers out of Cushing, some on Wall Street are going to increasingly tremendous lengths to gain an edge — such as using drones and infrared photo technology to get a peek inside its hundreds of oil tanks.

Dale Parrish, a 64-year-old retired firefighter and pilot, runs a small company, Hover Visions, out of Oklahoma City, offering aerial video and photography to a select roster of international clients, mostly data analytics firms that sell the information. They come from New York, London, Paris, and the Middle East. Parrish oversees drone flights over Cushing four to five times a week. He flies 400 feet — the legal limit — above the tank farms, taking up to 550 pictures per flight, using thermal and other advanced imaging technology to try to determine the supply levels inside the tanks.

“一切都有一个温度,所以当你使用热成像时,你可以看到坦克的水平以及有空间的地方,因为温度有所不同,”巴里斯说,他们在沙掌中计算了大约350个坦克。他说,当油价下降到零以下时,“一些坦克完全满了,但不像你想象的那么多。我的客户的所作所为,我不明白市场,但我听到正在发生的事情。我知道这很大。“

巴里斯说,坦克农场的空域不是没有无负性的空间。许多终端和管道运营商定期飞越其性质 - 有些不欣赏被拍摄或监控。“有一天,我从FBI有一个很好的小电话,”他说。“其中一家能源公司试图使我似乎正在运行邪恶的行动。”他能够在建立业务时与联邦当局有如此多的许多清关。“我知道是一个前消防员,即海门被认为是由国土安全指定的关键基础设施,所以我经历了相当多的批准,”他说。

对于那些称呼家居的人来说,审查是名誉历史学家的克雷克纳说,审查可能是激烈和疲倦的。他和他的妻子在Cushing Dovering北部购买了60亩,以逃避石油基础设施的稳定蠕变。如今,五个石油管道通过他的财产和飞机,用“管道巡逻”涂在翅膀上,每天飞过开销,调查它们 - 每个管道。

Kleckner为隐私和鹿狩猎买了他的家,但飞机从他的院子里跑了鹿,现在可以看到油箱到地平线。他说,虽然技术上,但所有者可能会拒绝允许管道运营商在他的土地上,在实践中,管道行业通常赢得了杰明域等法律演习。“到底你别无选择,”他解释道。“如果管道公司想要贯穿你的地方,他们将经营你的位置。如果你与他们争辩,他们会带你去法庭并强迫它。在俄克拉荷马州,法院给他们。“

Kleckner说,他在土地下面的管道上取出了至少六个数字,他也租了钻井,但他后悔了。“当我在这里搬出时,我有一个计划,它没有包括管道和储罐,”他说。“我希望我陷入该计划。它没有改善我的地方或处置。“

At night, when the tank farms are illuminated like football fields, “the lights blind me,” he says. But Kleckner will never leave.

“缓冲不为建筑物或油。这是关于人民的。这是关于缓冲的人。我出生在沙起里。我娶了一个缓冲的女孩,并在沙掌中筹集了三个孩子。他们会回来感恩节,“他说。“他们不能用蛇跑掉我。”