This content is from:APP亚博娱乐

特别报告:加强因素ETF的收入策略

从11月2020年的Blackrock替代品特别报告1

Managers of income strategies are faced with the dilemma of all-time low bond yields and dividend paying stocks exhibiting significant volatility. The questions these circumstances raise are: Do managers reduce income targets? Or take on more risk in search of yield? The answer may be neither, as this brief report explores.

1重子ETF如何帮助实现目标收入

Utilizing factors such as quality, minimum volatility, and value alongside existing equity/bond positions could help managers of income strategies maintain target income levels while seeking improved resilience.

Here’s how:

- 考虑分配股权和债券因子ETF目的是,有多样化与当今寻求战略相关的一些独特风险。这些可以包括特定的部门/因子偏差和特殊风险。

- Blackrock可以提供定制的投资组合咨询那including risk analysis, for institutional investors.

占83个多资产收入共同基金(“同行集团”)的Blackrock研究,代表资产超过2400亿美元1发现了重要的部门和因素风险。

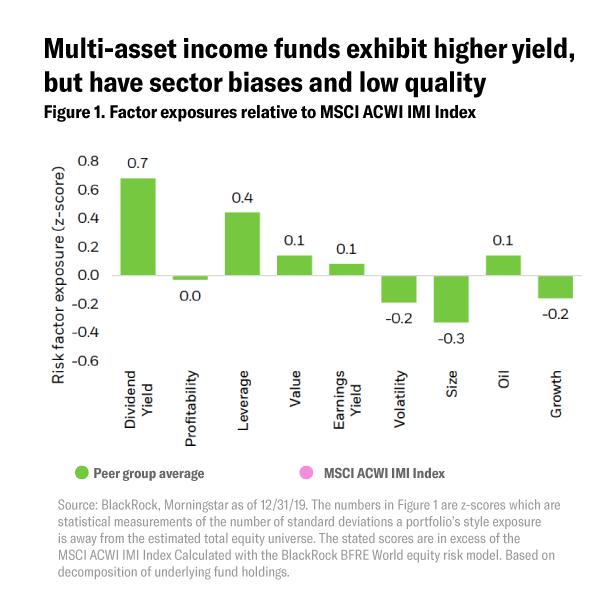

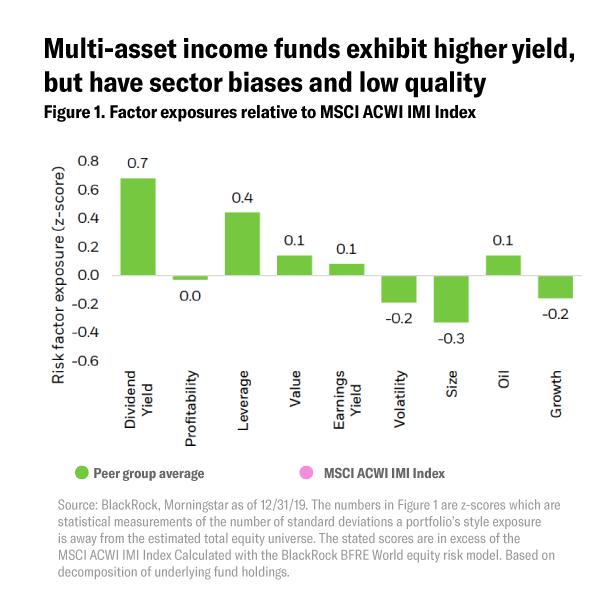

- Using a proprietary risk model, analysis of the peer group’s equity style factor exposures (see Figure 1, below) showed strong exposure to high dividend-yielding stocks, but at the cost of higher leverage and lower profitability – a negative quality bias which could drag on return. The average fund also exhibited meaningful smaller-cap, value, and anti-growth tilts.

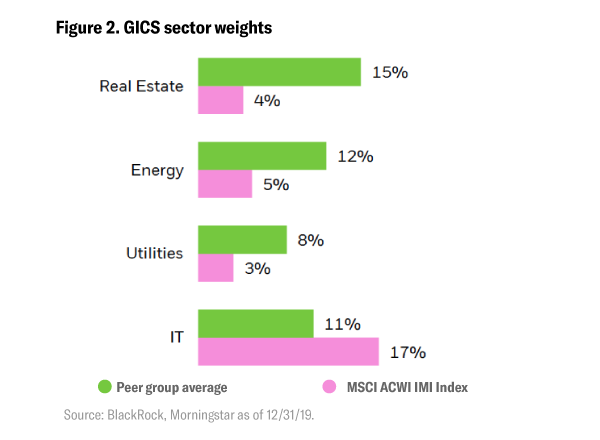

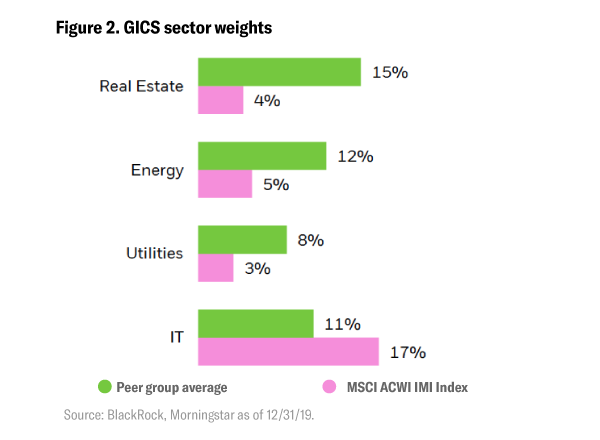

- 平均基金也显示出来对房地产,能源和公用事业部门的大超重(见下图2)。这些行业历史地支付了有吸引力的股息产量,但可以表现出对利率变化的敏感性增加和能源供需波动。

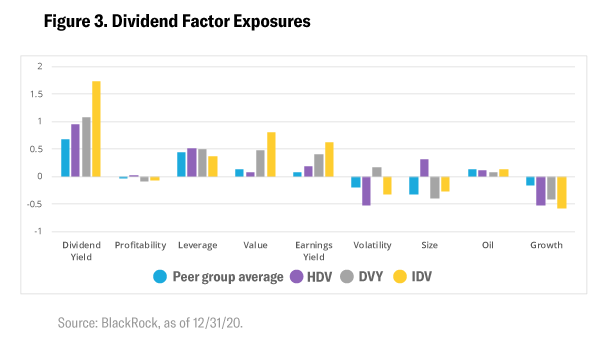

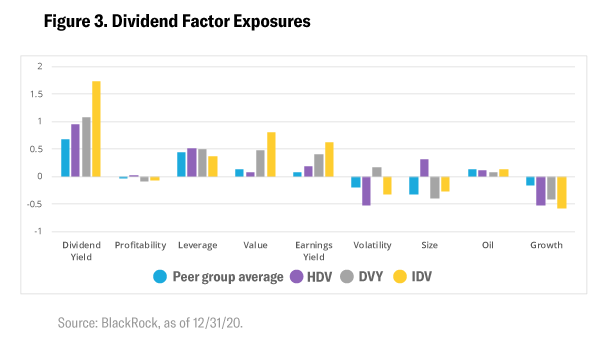

- Equity dividend ETFs (i.e., iShares Core High Dividend ETF [HDV], iShares Select Dividend ETF [DVY], iShares International Select Dividend ETF [IDV]) tend to exhibit similar directional factor exposures (see Figure 3, below).

更深的看法

“使用因子镜头进行收入组合可能有助于减少可能损害股权收入投资者的”收益陷阱“。例如,一些高产股票可能具有不可持续的支出和高挥发性。考虑到基于其基础知识的股票的质量特征可能有助于减少波动性并确保可持续的支付。为此,我们经常发现机构和财富投资者包括质量和最小的波动因素来补充收入组合。“

-Mark Carver, Managing Director, Global Head of Equity Factors, MSCI

“在投资领域,我们看到两种方法investors who have largely built their portfolios stock by stock and bond by bond, and others who use managed solutions run by their larger organization. If you’re someone who builds portfolios using individual securities, factors play a role, but you’re not necessarily always considering what factor exposures arise as a by-product of your stock selection. In that case, we can help clients form a view on momentum or increased volatility. We can show them how to potentially lower their overall volatility exposure with an ETF that gives them market-like exposure without requiring them to decide on which stocks they need to buy and sell.”

- Del Standord,Ishares Portfolio Consulting,Blackrock

1截至12/31/19

2因素如何帮助降低企业债券暴露的风险

发现足够的债券收入变得越来越难,领先的投资组合管理人员通过延长持续时间和降低信用质量来承担更多风险。同行集团的平均基金将超过一半的固定收入袖/分配分配给公司债券(见下文),与总债券基准的有意义差异。1这些企业债券分配中包含的投资级和高收益债券可能具有较低的质量,以实现收入目标,这增加了投资组合的风险。

Fixed income factors like quality and value can offer risk diversification and help investors manage downside risk while maintaining similar or higher levels of yield. iShares Investment Grade Bond Factor ETF (IGEB) and iShares High Yield Bond Factor ETF (HYDB) seek to target these two factors in the corporate bond space.

质量因素筛选债券具有更高的默认概率,将投资组合倾斜,以具有更高默认调整的差价的公司债券。这种较低的默认概率可以伴随着较低的产量。这就是为什么质量因子互补的值因素,这是债券相对于他们的基本面便宜的界面。

上述Ishares ETF表现出较低的默认概率和相似或更高的收益率(见下图5,下文),帮助管理者继续分配给IG和HY公司债券,以追求更高的收入,可能更少的风险。

更深的看法

“随着因素ETF,股票的质量和最小波动的巨大范围,固定收入的质量和价值,以帮助满足收入需求,随着额外保护的多样化和额外保护。

-Andrew Ang,Factor投资策略,Blackrock

“因素行为有助于客户了解资产在科夫迪造成的经济不确定性期间如何定价。结果是更多客户在系统地测量其股票计划中的因子风险,以更好地了解其风险暴露,并重新定位投资组合以表达投资意见。大流行引起的不确定性使得评估公司基本面难以加上美国股票的高浓度,有利于2020年的大部分势头这样的技术因素。但是,客户要求提供像价值等的亲周期性因素可能会加强2020年市场恢复岩体变成了经济复苏。“

-Mark Carver, Managing Director, Global Head of Equity Factors, MSCI

1基准是Bloomberg Barclays美国汇总债券指数。

3.A Case Study of Factor-Aware Income Generation

在Covid-19危机和随后的股权波动危机的后果,企业债券降级和记录低利率,许多多资产收入组合管理人员正在重新评估如何减轻寻求产量的风险。

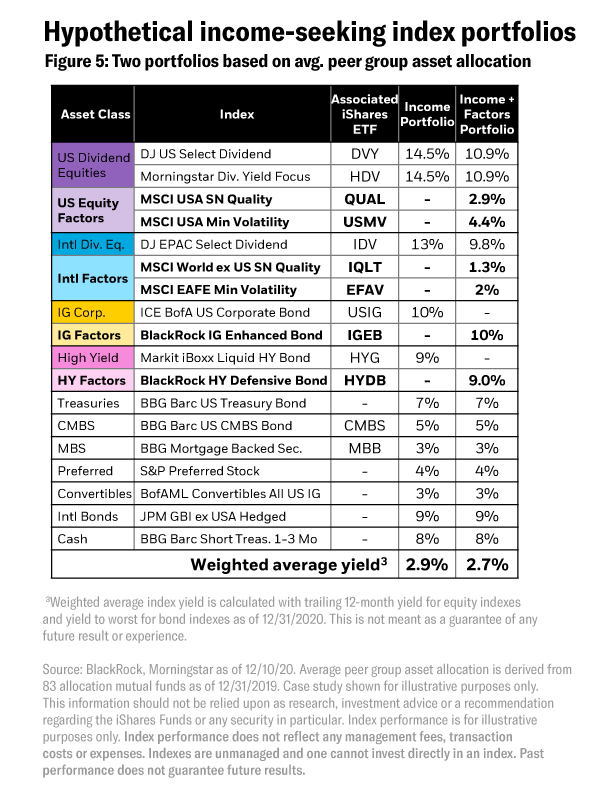

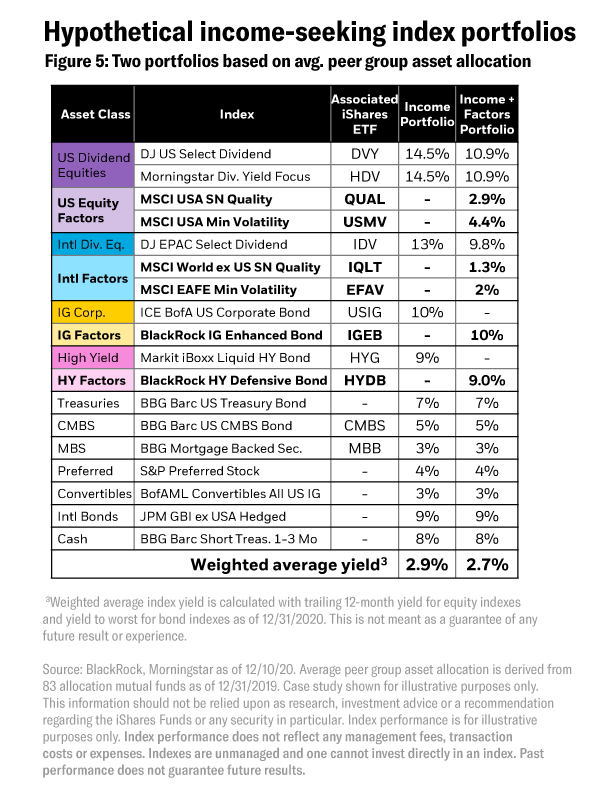

Deriving an assumed global multi-asset allocation from the peer group average, two hypothetical index-based portfolios were constructed.

- Income:The asset allocation is populated with dividend-focused equity and broad-market fixed income indexes. This represents a typical income-seeking multi-asset portfolio.

- 收入+因素:Seeks to enhance the Income portfolio by allocating 25% of equities to factor indexes and fully replacing traditional corporate bond indexes with factor-based indexes.

收入+因素产品组合对因素指标进行了小分配:

- 多样化因素和部门偏见

- 保持类似的产量水平

- 提高风险调整的性能

在收入+因素组合中包含因子指标将具有多元化的因素风险,使得投资组合减少对价值导向因子(见下文)。通过更高的盈利能力和较低的杠杆属性来提高质量因素,投资组合将更多地接触低波动股。升级的质量和低波动率曝光可能会在抛售期间提高产品组合弹性。增长曝光会变得较低,而石油也将接近全球基准。

The weighted average yield (above) shows that allocating a portion of the portfolio to factor-targeting strategies may maintain a similar level of yield.

更深的看法

“当多资产策略中有汇集资金时,通常会有如此多的多样化,它看起来像索引 - 没有显着的主动赌注。个人积极管理人员正在活跃,但它们的职位降低了投资组合的总体主动风险,而且表现优于优势的机会。正如他们开始使用因素的那样,它们可以从目前的积极策略中区分曝光。因此,如果他们愿意将分配给一些积极的战略并使用因素ETF,他们可以增加他们的积极风险水平及其优于优势的机会。投资者和管理人员往往没有概念化这一点,因为ETF有时被视为广基指标的车辆。“-Del Standord,Head of iShares Portfolio Consulting, BlackRock

“One area that hasn’t been widely considered by income-seeking investors is to use factor strategies and factor ETFs to complement traditional sources of income. Using factor ETFs can lead to a more robustly constructed portfolio, and in some cases, even greater income as measured by dividend yields or cashflow payouts. In the first half of 2020 we saw very large drawdowns to traditional multi-asset income funds because they have large sector overweights, in particular to the real estate, energy, and utility sectors. Those sectors traditionally offer high yields, but they have potentially large sensitivities to changes in interest rates and economic growth, and to potential policy shocks – three things we had in abundance in early 2020. Those large sector overweights potentially drive higher volatility and risk, and factor ETFs can help diversify that risk while helping investors manage the downside and maintain similar or higher levels of yield. We can do that in both equities and fixed income.”-Andrew Ang,Factor投资策略,Blackrock

仅供机构使用 - 不适用于公共发行

在投资前仔细考虑资金的投资目标,危险因素和费用和费用。可以通过访问www.ishares.com或www.blackRock.com,在资金招股说明书中或其他信息中找到这些信息,或者,如果可用,则可以通过访问www.ishares.com或www.blackrock.com获得。投资前仔细阅读招股说明书。

Investing involves risk, including possible loss of principal.

固定收入风险包括利率和信贷风险。通常,当利率上升时,债券值的相应下降。信用风险是指债券发行人将无法制定本金和利息的可能性。非投资级债务证券(高收益/垃圾债券)可能会受到更大的市场波动,违约风险或收入损失和校长的股票和均优于较高的证券。

没有保证,绩效将加强或冒险的风险将用于寻求暴露于某些定量投资特征(“因素”)的资金。暴露于此类投资因素可能会减损某些市场环境中的性能,也许是延长的时期。在这种情况下,基金可能会寻求保持对目标投资因素的接触,并不适应目标不同的因素,这可能导致损失。

讨论的策略严格用于说明和教育目的,并非推荐,要约或征求购买或销售任何证券或采用任何投资策略。无法保证所讨论的任何策略都会有效。提出的信息不考虑委员会,税收影响或其他交易成本,这可能会影响特定战略或投资决策的经济后果。

由Blackrock Investments,LLC,成员Finra准备。

ISHares资金未得到赞助,由MSCI Inc.赞亚博篮球怎么下串助,签发,销售或宣传,也不是这家公司对投资资金的可取性作出任何代表性。Blackrock没有隶属于MSCI Inc.

©2020 BlackRock,Inc。保留所有权利。ishares.和BLACKROCK是BlackRock,Inc。的商标,或者在美国和其他地方的子公司的商标。所有其他商标都是其各自所有者的财产。

ICRMH0221U / S-1458009