This content is from:APP亚博娱乐

A Case Study of Factor-Aware Income Generation

From the Nov 2020 BlackRock Alternatives Special Report 1

Managers of income strategies are faced with the dilemma of all-time low bond yields and dividend paying stocks exhibiting significant volatility. The questions these circumstances raise are: Do managers reduce income targets? Or take on more risk in search of yield? The answer may be neither, as this brief report explores.

1How Factor ETFs Can Help Achieve Target Income

Utilizing factors such as quality, minimum volatility, and value alongside existing equity/bond positions could help managers of income strategies maintain target income levels while seeking improved resilience.

Here’s how:

- Consider allocating to equity and bond factor ETFswith the goal of diversifying some of the unique risks associated with today’s income-seeking strategies. These can include specific sector/factor biases and idiosyncratic risks.

- BlackRock can provide customized portfolio consulting, including risk analysis, for institutional investors.

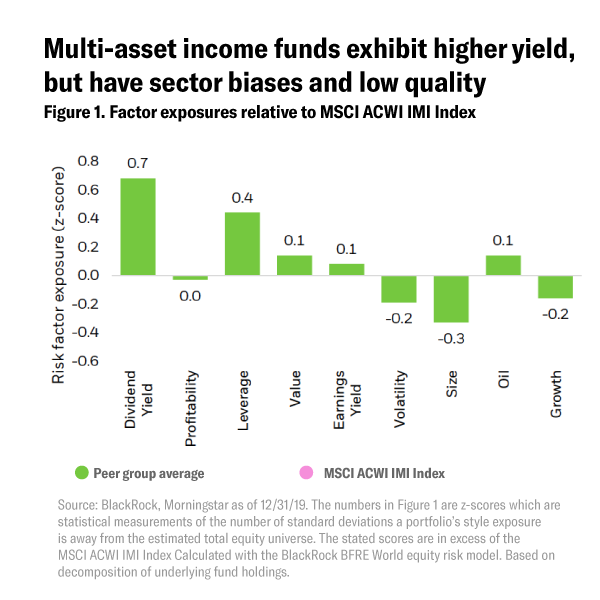

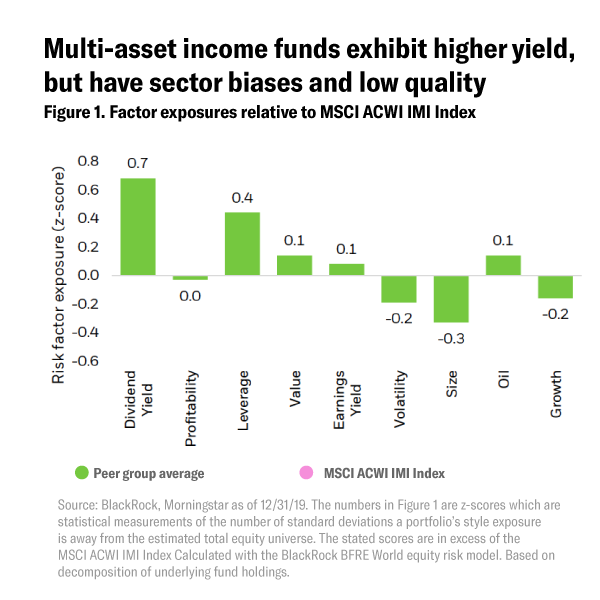

A BlackRock study of 83 multi-asset income mutual funds (“peer group”) representing over $240 billion in assets1found significant sector and factor risks.

- Using a proprietary risk model, analysis of the peer group’s equity style factor exposures (see Figure 1, below) showed strong exposure to high dividend-yielding stocks, but at the cost of higher leverage and lower profitability – a negative quality bias which could drag on return. The average fund also exhibited meaningful smaller-cap, value, and anti-growth tilts.

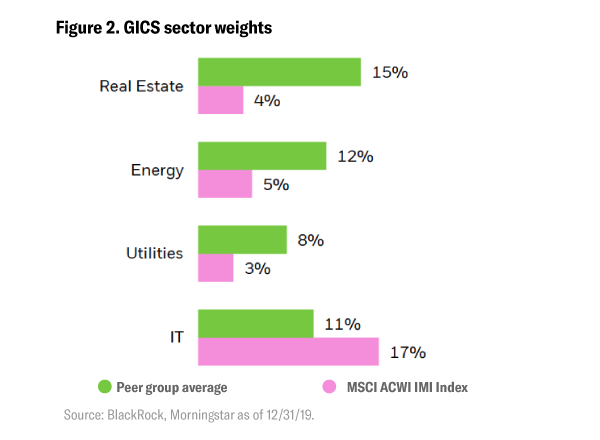

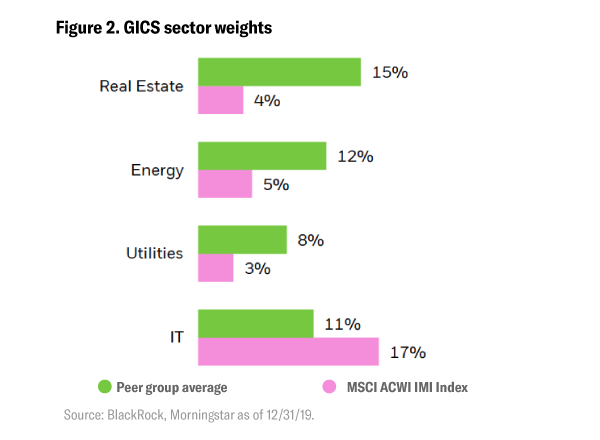

- The average fund also showedlarge overweights to the real estate, energy, and utilities sectors(see Figure 2, below). These sectors have historically paid an attractive dividend yield but can exhibit increased sensitivity to interest rate changes and fluctuations in energy supply and demand.

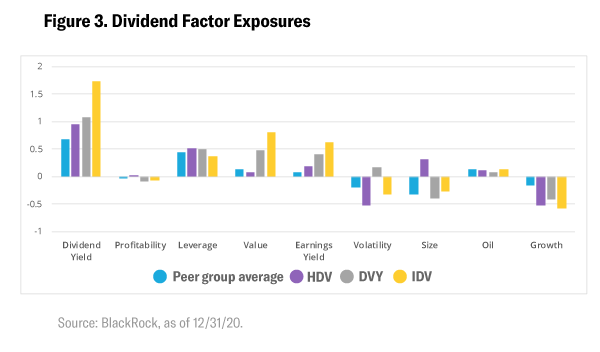

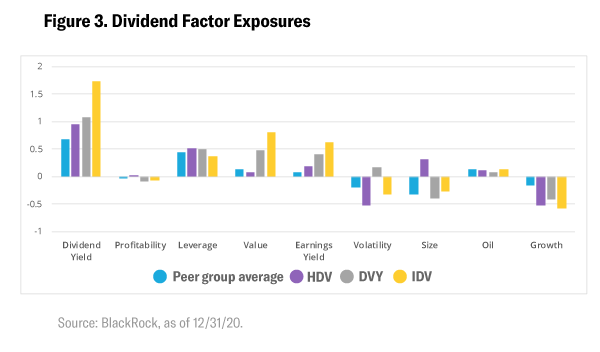

- Equity dividend ETFs (i.e., iShares Core High Dividend ETF [HDV], iShares Select Dividend ETF [DVY], iShares International Select Dividend ETF [IDV]) tend to exhibit similar directional factor exposures (see Figure 3, below).

Deeper Look

“Using a factor lens for an income portfolio may help reduce the ‘yield traps’ that can hurt the equity income investor. For example, some high yield stocks may have unsustainable payouts and high volatility. Considering the quality characteristics of a stock based on its fundamentals may help reduce volatility and ensure a sustainable payout. To this end we often find institutional and wealth investors include quality and minimum volatility factors to complement the income portfolio.”

– Mark Carver, Managing Director, Global Head of Equity Factors, MSCI

“在投资领域,我们看到两种方法investors who have largely built their portfolios stock by stock and bond by bond, and others who use managed solutions run by their larger organization. If you’re someone who builds portfolios using individual securities, factors play a role, but you’re not necessarily always considering what factor exposures arise as a by-product of your stock selection. In that case, we can help clients form a view on momentum or increased volatility. We can show them how to potentially lower their overall volatility exposure with an ETF that gives them market-like exposure without requiring them to decide on which stocks they need to buy and sell.”

– Del Stafford, Head of iShares Portfolio Consulting, BlackRock

1As of 12/31/19

2How Factors Can Help Reduce Risk in Corporate Bond Exposures

Finding sufficient bond income has become harder, leading portfolio managers to take on more risk by extending duration and reducing credit quality. The average fund in the peer group allocated more than half of its fixed income sleeve/allocation to corporate bonds (see Figure 4, below), a meaningful difference from the aggregate bond benchmark.1The investment grade and high yield bonds contained within those corporate bond allocations may be of lower quality to achieve income targets, which adds risk to portfolios.

Fixed income factors like quality and value can offer risk diversification and help investors manage downside risk while maintaining similar or higher levels of yield. iShares Investment Grade Bond Factor ETF (IGEB) and iShares High Yield Bond Factor ETF (HYDB) seek to target these two factors in the corporate bond space.

The quality factor screens out bonds with a higher probability of default, tilting a portfolio towards corporate bonds with higher default-adjusted spreads. This lower average probability of default could be accompanied by lower yield. This is why the quality factor is complemented by the value factor, which screens for bonds that are cheap relative to their fundamentals.

The aforementioned iShares ETFs exhibit lower probability of default and similar or higher yield (see Figure 5, below) than their traditional counterparts, helping managers continue to allocate to IG and HY corporate bonds in pursuit of higher income with potentially less risk.

Deeper Look

“With factor ETFs, there’s tremendous scope for quality and minimum volatility in equities, and quality and value in fixed income, to help meet income needs with increased diversification and potential for additional protection on the downside.

– Andrew Ang, Head of Factor Investment Strategies, BlackRock

“Factor behavior has helped clients understand how assets are being priced during this period of economic uncertainty caused by COVID. The result is more clients systematically measuring the factor exposures across their equity program to better understand their risk exposures and to re-position the portfolio to express their investment views. The uncertainty caused by the pandemic has made it harder to evaluate company fundamentals, coupled with the high concentration in US equities, has favored technical factors like momentum for much of 2020. However, clients are asking whether pro-cyclical factors like value may strengthen as the 2020 market recovery morphs into an economic recovery.”

– Mark Carver, Managing Director, Global Head of Equity Factors, MSCI

1Benchmark is the Bloomberg Barclays US Aggregate Bond Index.

3A Case Study of Factor-Aware Income Generation

In the aftermath of the COVID-19 crisis and subsequent historic spike in equity volatility, corporate bond downgrades, and record low interest rates, many multi-asset income portfolio managers are re-evaluating how to mitigate the risks that arise from seeking yield.

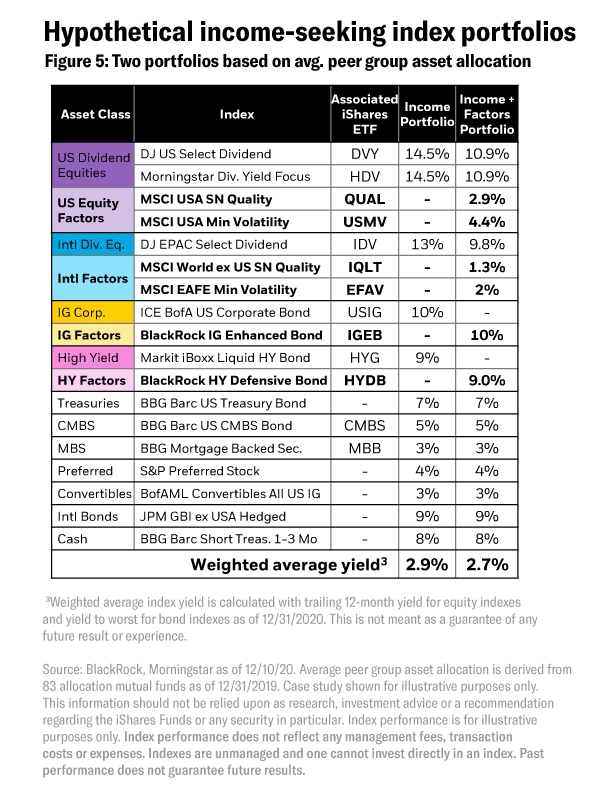

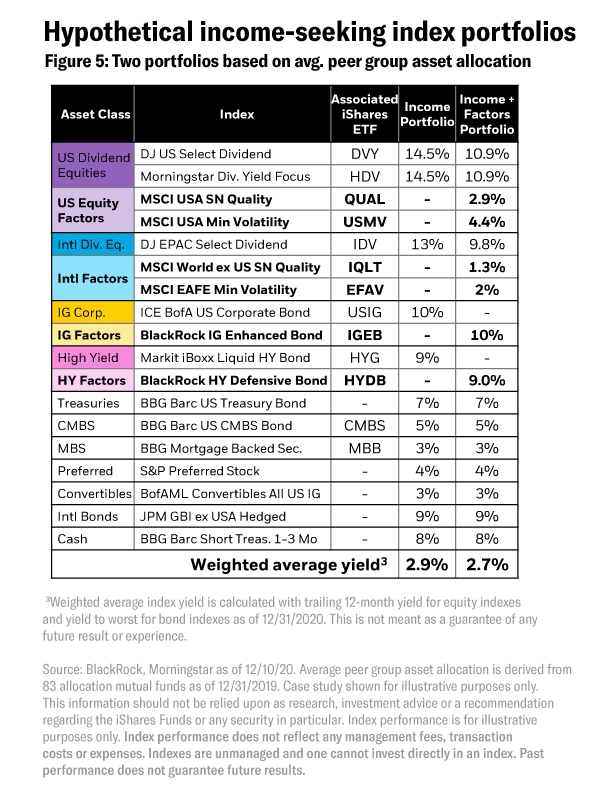

Deriving an assumed global multi-asset allocation from the peer group average, two hypothetical index-based portfolios were constructed.

- Income:The asset allocation is populated with dividend-focused equity and broad-market fixed income indexes. This represents a typical income-seeking multi-asset portfolio.

- Income + Factors:Seeks to enhance the Income portfolio by allocating 25% of equities to factor indexes and fully replacing traditional corporate bond indexes with factor-based indexes.

The Income + Factors portfolio makes a small allocation to factor indexes with the objectives of:

- 多元化因素和行业偏见

- Maintaining a similar level of yield

- Improving risk-adjusted performance

The inclusion of factor indexes in the Income + Factors portfolio would have diversified factor exposures, making the portfolio less reliant on value-oriented factors (see Figure 7, below). The quality factor would have been improved through higher profitability and lower leverage attributes, and the portfolio would have had more exposure to low-volatility stocks. Upgraded quality and low volatility exposure can potentially improve portfolio resilience during selloffs. Growth exposure would have become less negative, and oil would also have moved closer to that of the global benchmark.

The weighted average yield (above) shows that allocating a portion of the portfolio to factor-targeting strategies may maintain a similar level of yield.

Deeper Look

“When there are pooled funds within a multi-asset strategy, there’s often so much diversification that it looks like the index – there aren’t significant active bets. Individual active managers are being active, but their positions in aggregate lower the overall active risk of the portfolio, and the chances of outperforming are reduced. As they begin to use factors, they can differentiate exposures from their current active strategy. So, if they’re willing to reduce allocations to some of those active strategies and use a factor ETF, they can increase their active risk level and their chances of outperforming. Investors and managers often haven’t conceptualized this because ETFs are sometimes seen solely as vehicles for broad-base indexes.”–Del Stafford,Head of iShares Portfolio Consulting, BlackRock

“One area that hasn’t been widely considered by income-seeking investors is to use factor strategies and factor ETFs to complement traditional sources of income. Using factor ETFs can lead to a more robustly constructed portfolio, and in some cases, even greater income as measured by dividend yields or cashflow payouts. In the first half of 2020 we saw very large drawdowns to traditional multi-asset income funds because they have large sector overweights, in particular to the real estate, energy, and utility sectors. Those sectors traditionally offer high yields, but they have potentially large sensitivities to changes in interest rates and economic growth, and to potential policy shocks – three things we had in abundance in early 2020. Those large sector overweights potentially drive higher volatility and risk, and factor ETFs can help diversify that risk while helping investors manage the downside and maintain similar or higher levels of yield. We can do that in both equities and fixed income.”–Andrew Ang, Head of Factor Investment Strategies, BlackRock

FOR INSTITUTIONAL USE ONLY - NOT FOR PUBLIC DISTRIBUTION

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

There can be no assurance that performance will be enhanced or risk will be reduced for funds that seek to provide exposure to certain quantitative investment characteristics ("factors"). Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. In such circumstances, a fund may seek to maintain exposure to the targeted investment factors and not adjust to target different factors, which could result in losses.

讨论的策略是illustra严格tive and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective. The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

Prepared by BlackRock Investments, LLC, member FINRA.

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by MSCI Inc., nor does this company make any representation regarding the advisability of investing in the Funds. BlackRock is not affiliated with MSCI Inc.

©2020 BlackRock, Inc. All rights reserved.iSHARESandBLACKROCKare trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.