This content is from:APP亚博娱乐

Improvers Prove to Be Movers in Sustainable Fixed Income

他们可能会在可持续发展主题投资组合中持有一个有吸引力的风险奖励简介。

A combination of issuers viewed as sustainability leaders and improvers – companies that got off to a slow start from a sustainability perspective but now demonstrate a clear commitment to sustainability – may provide an attractive risk-reward profile in a sustainability-themed fixed income portfolio. This thesis has been put forth and tested by a team at Aegon Asset Management led by James Rich, Senior Portfolio Manager on the firm’s sustainable fixed income strategy.

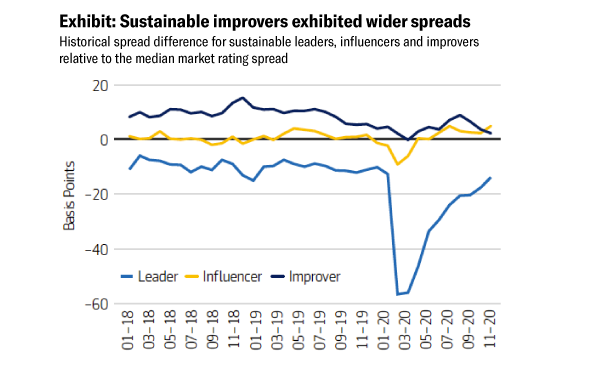

The report, “Sustainability & Credit Spreads: From Leaders to Improvers“建议称为可持续发展领导者的发行人可以在增强波动期间提供下行保护,并且改进者可以提供更高的差价和上行潜力。Based on the analysis of IG corporate issuers within the firm’s sustainable investment universe, sustainable improvers have offered a higher-than-average spread relative to leaders or influencers – a group that is well along the sustainability journey but not quite in the leader category – over a three-year period, after adjusting for duration and credit quality.

After reading the report and its intriguing perspective, II spoke with Rich about it.

你是如何得出你在论文中建议的结论的?

James Rich:这是对分析的简单解释:我们采取了我们的投资级企业可持续领导者,改进剂和影响者的宇宙,我们随着时间的推移看了这些发行人的传播。对于发行人的所有债券,我们通过使用回归分析测量每个安全的扩展来控制持续时间和信用质量。然后,我们将结果汇总为我们的可持续类别,并研究了博克斯格巴克莱美国公司债券指数中其他债券交易的债券如何,具有类似的信用质量和持续时间。我们发现的是,那些符合我们专有的改善机构定义的发行人往往往往比平均水平宽。领导者往往比平均水平更快地交易。换句话说,向可持续发展主题的投资组合增加改善机会可以提供增加产量的机会。此外,随着改善机构加强其可持续性概况和从改善机构转变为领导者,我们预计将它们的差价随着时间的推移而压缩,从而提供潜在的长期过剩机会。

是,随着改善机器采用更可持续的产品和实践,您期望信用风险随着时间的推移而减少吗?

富有的:Yes. We believe that those issuers aligned with long-term secular shifts, such as the pivot toward global sustainability, are also better positioned to manage risk and achieve a durable competitive advantage. In other words, issuers may have higher credit risk when they have lower alignment. But if they’re serious about transitioning and increasing their alignment to sustainability we would expect credit risk to decline and spreads to tighten as the company accelerates its sustainable progress, all else equal.

What criteria do you use to identify a company as a sustainable improver?

富有的:We built a proprietary approach to assess issuers’ alignment with long-term sustainable megatrends. The process is tailored to each fixed income issuer type and considers three key dimensions of sustainability: product and services; business practices; and momentum or commitment to sustainability. For corporate credit, this assessment typically focuses on the percentage of revenue aligned to sustainable initiatives. We also look for a stated intention and demonstrated commitment to continue to grow that percentage. For example, one company we considered an improver hasn’t actually improved – the percentage of alignment with sustainable initiatives is the same today as it was two years ago. They aren’t demonstrating their commitment, so we are downgrading them from improver status to neutral status, which also serves to remove them from the eligible investment universe for our sustainability-themed fixed income strategy.

为什么首先拥有可持续性主题战略是有意义的?

富有的:作为长期投资者,我们的目标是将客户的投资组合与长期的世俗趋势一致。无论是对电子商务,数字化还是自动化的转变,只是为了少数,我们的工作是识别长期获奖者和输家,最终产生最高的风险调整的回报。在我们看来,可持续性是一个关键的世俗移位,已经开始改变全球经济。随着时间的推移,我们预计与可持续性有高协调的公司将有更好的机会确保竞争优势。并没有认真对待它的企业越来越多地落后于同龄人。在某些情况下,即使整个部门也有落后的风险。这是我们可持续发展主题的固定收入方法的核心。

本文还占据可持续领导人在波动性上升期间的下行保护。你是怎么到达这一结论的?

富有的:We looked at the performance of sustainable leaders during the March and April timeframe of 2020, when there was a huge downdraft of risk assets. Because leaders trade tighter than average when controlling for credit quality and duration, you might think that in a market downdraft they would be at the highest risk of widening. But what we found in the March and April timeframe was that the spreads of these investment grade corporate issuers did not widen relative to the average for their credit quality and duration – they actually tightened on average. If you look at the data, the leaders were humming along right around 10 basis points tighter than average until early 2020, then they dropped all the way to 50 basis points tighter than average. In other words, the leaders provided stability to the portfolio. Interestingly, the improvers also dipped down, but not as much. So, the combination of the leaders in a downdraft environment and improvers when the market is sailing potentially provide a nice portfolio of downside protection and upside opportunity in a fixed income context.

来源:Aegon点。1月1日20日开始扩散数据18 through December 31, 2020. Reflects the historical mean spread relative to the median rating spread. Includes US corporate bonds in Aegon AM’s sustainable investment universe as of December 31, 2020 based on the firm’s proprietary sustainability assessment. For illustrative purposes only.参考附加的完整的研究报告formation。

您的方法是否依赖于领导者,影响因素和改进者的设定百分比?

富有的:No. We try to find the best long-term investment ideas across the three eligible sustainable categories – leader, influencer and improver. We exclude issuers categorized as neutral or detrimental that do not demonstrate sufficient alignment with sustainable megatrends. In favor of flexibility, we don’t mandate a certain percentage in each eligible category. This allows portfolio managers the ability to identify the most attractive investments within the eligible universe and position the portfolio to reflect their views across sectors, industries, duration, credit quality, etc. Further, as our research suggests, a combination of issuers at various stages in their sustainable journey can provide an attractive risk-reward profile.

Does demand for sustainable investment strategies drive lazy solutions in some cases?

富有的:The risk of greenwashing is certainly picking up. Some asset managers that label their strategies as “sustainable” or even “impact” tend to be more of what we would define as a best-in-class ESG strategy. Such strategies may be overweight companies with the best ESG characteristics relative to industry peers and underweighting those with business practices that lag. Both approaches have their merits, but using third-party research instead of proprietary research, the lack of standards, and convoluted terminology require that investors conduct deep due diligence to truly understand the sustainability profile of the strategy. Other sustainability-themed strategies may focus only on the labeled bond market – green bonds, social and sustainability bonds, etc.Labeled bondsare certainly one way to invest in sustainability, and they are part of our sustainability-themed investing approach, but they’re not the predominant source of sustainable investing opportunities, and greenwashing risk in this segment is rising rapidly as demand grows

For all the reasons I mentioned, we favor a comprehensive approach to可持续发展主题投资that centers on proprietary fundamental research and assesses sustainability across multiple dimensions – products and services, business practices, and commitment to advancing sustainability. We’ve found that those three elements provide a far larger opportunity set of compelling sustainable investment opportunities across the fixed income spectrum.

Related content:

Sustainability & Credit Spreads: From Leaders to Improvers

Green Bonds: Peeling Back the Label

Disclosures

此材料仅供媒体使用。它包含经理的当前意见,此类意见可能会有所变化,恕不另行通知。AEGON AM美国不义务,表达或暗示,以更新本文所载的材料。此材料仅包含投资事项的一般信息;不应被视为任何问题的综合声明,不应依赖于此

All investments contain risk and may lose value. Responsible investing is qualitative and subjective by nature, and there is no guarantee that the criteria utilized, or judgment exercised by any company of Aegon Asset Management will reflect the beliefs or values of any one particular investor. There is no guarantee that responsible investing products or strategies will produce returns similar to traditional investments.

There is no guarantee that any investment strategy will work under all market conditions or is suitable for all investors. Investors should evaluate their ability to invest over the long-term, especially during periods of increased market volatility. All investments contain risk and may lose value.

本文包含基于公司信仰的前瞻性陈述,以及根据目前可用的信息,以及未来事件的许多假设,并且恕不另行通知。这些陈述涉及难以预测的某些风险,不确定性和假设。因此,此类陈述不能保证未来的绩效,实际结果和返回可能与本文规定的陈述有所不同。

AEGON资产管理美国是一名美国证券交易委员会注册投资顾问,也载为商品期货交易委员会(CFTC)的商品交易顾问(CTA),是全国期货协会(NFA)的成员。AEGON资产管理美国是AEGON资产管理的一部分,是AEGON集团的全球投资管理品牌。

©2021 Aegon Asset Management or its affiliates. All rights reserved.