This content is from:APP亚博娱乐

Higher Rates Create Buying Opportunity in Investment Grade Corporate Bond Market

Executive summary

- Not only has U.S. Investment Grade (IG) Credit performed well in the most recent period of rising rates, spreads for the asset class have historically tightened when rates have risen in the past.

- 夏普和突然的运动在历史上been most disruptive for IG Credit. However, given the robust market backdrop for IG Credit we believe that additional episodes of spread widening will likely be temporary, a dynamic that will create attractive entry points for investors in the near term.

- 在通胀上升期间,IG信贷也历史上表现优于优势。

缓慢而稳定:IG信贷在速度和通胀运动逐渐下表现良好

最高率和更高的通货膨胀仍然是美国投资级(“IG”)信用的国内外投资者最常见的局部问题。进入2021年,我们讨论了各种因素,可能导致美国利率更高,令人难以置信的财政部曲线,特别是高于趋势经济增长,财政部资金资金刺激的丰富,以及较高的周期性通胀。我们还注意到了几个因素,我们认为,在我们的临近中期可以在近代中期移动的高度和陡峭,包括全球产量差异,持续的宽容性货币政策和量化宽松,以及缺乏结构性通胀的程度。在这篇文章中,我们将讨论为什么我们认为这个速度上升对IG信贷市场不会破坏。

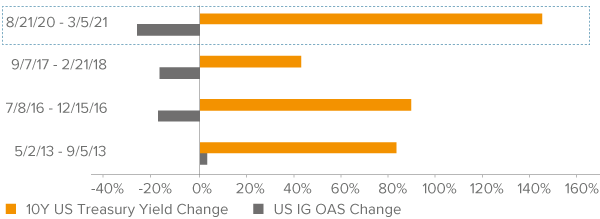

以来稳步上升ir lows in August 2020, Treasury yields pulsed higher in February 2021, with the yield on the 10-year note settling at 1.39% as of month end after reaching an intra-day high of 1.61% on February 25. Despite this move higher, we maintain our stance that further steepening will be gradual, albeit with potential short-term bouts of volatility, leading to more attractive entry points for fixed income investors. Encouragingly, credit markets have remained resilient, with spread moves mostly muted. As Figure 1 highlights, IG Credit has historically performed very well in periods of rising rates, as spreads have tightened in 3 out of the last 4 periods of rising rates (negative percentage change in OAS indicates spread tightening or positive excess performance for IG Credit). In the most recent period of rising rates, IG Credit has actually posted its best performance.

图1. IG信用卡在上次涨幅期间主要收紧

IG在上升率期间蔓延

截至02/22/21。资料来源:瑞士信贷。使用归一化百分比移动定义的上升率期。OAS中的负百分比变化表明,IAG信用的积极过度表现。

情节率波动强化了积极管理的重要性

虽然升高的速率波动可能导致差价扩大,但市场背景表明,任何移动更宽都会被证明是暂时的。首先,最近的速率波动与经济实力的重读有关,而不是率下降,基本的外观疲软。换句话说,我们相信任何传播扩展将是一个更临时的事件,因为它不是更大的图片信誉市场挑战的前兆。此外,更大的图像结果往往受到财务状况的结果的影响,这很容易,并将保持可预见的未来。市场已经提高了对利率徒步旅行的预期,暗示未来的财务状况可能收紧的令人担忧比预期更快。有了这一说,这种风险现在已经在很大程度上售价,随后的速度从这里移动可能更加渐进。

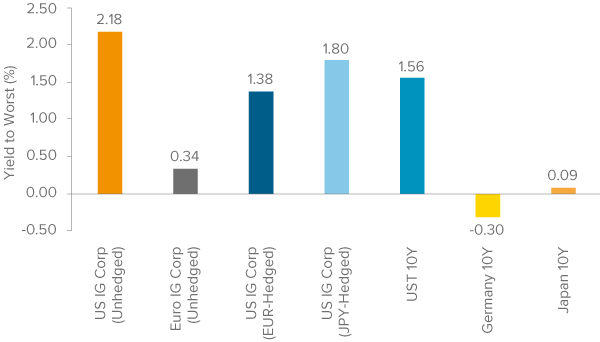

Second, higher yields in a low global yield environment will continue to attract demand for IG Credit from yield-based buyers, particularly pension plans and overseas buyers with hedging costs remaining low. As shown in Figure 2, the yield advantage of U.S. IG Credit over other fixed income sectors remains significant on both an unhedged and hedged basis.

图2.相对值:IG信用继续提供有吸引力的收益率

As of 03/05/21. Source: Bloomberg.

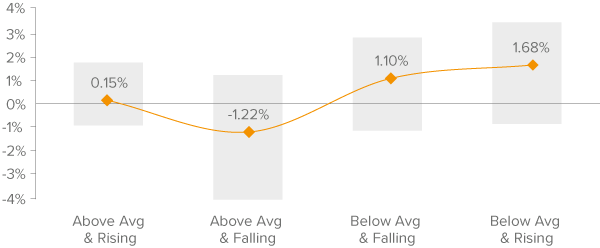

除了一个有利的技术背景外,IG信用基础也强大,这也应该有助于缩短差价更高的举措。国债收益率较高主要是反思,由美国强大的标称GDP增长持续乐观驱动,近期通胀问题也是一个因素,但通货膨胀,名义GDP增长和企业销售增长都是高度相关的。在我们看来,在劳动力市场中仍有过多的经济能力,在劳动力市场(现有全球灭火压力之上)在结构通胀中造成持续的举动。相反,我们预期将存在临时通胀脉冲,其自然界将更周期性。与此同说,即使是平均低于平均而且通胀升高,经济和企业销售增长的相关高度应净利润,历史上与信贷与国债的表现相关联(图3)。

Figure 3: IG Credit Has Historically Outperformed Treasuries During Periods of Rising Inflation

US IG Excess Forward 12m Returns by Inflation Bucket

As of 02/05/21. Source: Bloomberg, Morgan Stanley Research. Note: Orange dots show median while gray bars show interquartile range. Data series starts in 1970 and inflation buckets are defined using changes in U.S. headline CPI.

虽然更高的投入成本伤害了一些公司,但其他人赚钱,而且有可能比输家更多的胜利者。如果发生了消费者价格通胀,可能会有公司通过整个供应链通过成本,尽管可能在分销渠道的每个级别都有100%通过100%。这将建议一个比仅在利润率下降的投入成本通胀,这将提出一个更广泛的“获奖者”。此外,输入成本只是最终销售价格的一部分,因此公司不一定需要100%的通行证,以维持他们的利润。尽管有强劲的投入成本通胀,那么一个及时的例子是家庭建筑物,这是一个繁荣的行业。木材价格飙升但建造者边距仍在扩大鉴于强大的房屋销售价格。

Ultimately, a continued move higher in rates could lead to a move wider in spreads, but there is a limit to how high rates can go without a change in policy signaling from central banks. We do not think rates can reach levels that would have a negative impact on credit, as refinancing would remain cheap even at those higher yield levels, and the impact on interest coverage ratios will be slow moving. As such, we believe any spread widening would be temporary and we would look at any such event as a buying opportunity given the positives of an improving economic environment and presumably declining credit risk should dominate.

For additional detail or more from Voya Investment Management, click here.

Past performance does not guarantee future results. This commentary has been prepared by Voya Investment Management for informational purposes. Nothing contained herein should be construed as (i) an offer to sell or solicitation of an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. Any opinions expressed herein reflect our judgment and are subject to change. Certain of the statements contained herein are statements of future expectations and other forward-looking statements that are based on management's current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to, without limitation, (1) general economic conditions, (2) performance of financial markets, (3) interest rate levels, (4) increasing levels of loan defaults (5) changes in laws and regulations and (6) changes in the policies of governments and/or regulatory authorities.

The opinions, views and information expressed in this commentary regarding holdings are subject to change without notice. The information provided regarding holdings is not a recommendation to buy or sell any security. Fund holdings are fluid and are subject to daily change based on market conditions and other factors.

CID# 1567432

©2021 Voya Investments Distributor, LLC • 230 Park Ave, New York, NY 10169 • All rights reserved.